Section 302 states that the Chief Executive Officer and Chief Financial Officer are directly responsible for the accuracy, documentation, and submission of all financial reports and the internal control structure to the SEC. Every public company must file periodic financial statements and the internal control structure with the SEC. SOX department designs the transaction level controls, as well as all controls, and reports on the operating effectiveness in place to manage, while internal audit departments perform operating effectiveness on independent assessment. On the other hand, internal audit is a profession in which help is provided to an organization to achieve its objectives. The SOX Auditor performs SOX self-evaluation testing for all business processes including IT features and entity stage controls. The SOX Auditor stories results to management in order that remediation could be carried out and then updates appropriate documentation.

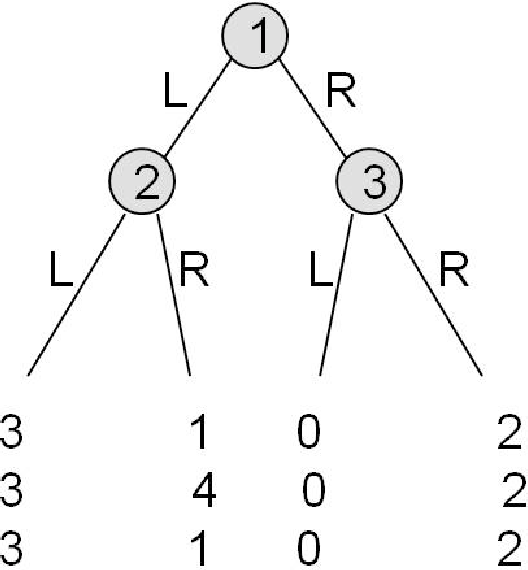

When the initial list of an entity’s IUC is considered relatively complete, then the next step includes sitting down with the control owners who execute/perform the controls to gather additional information. Obtaining this understanding will assist the practitioner to determine what steps are taken by the control performer to ascertain that the documents their controls are dependent upon are complete and accurate. Information Used by the “Company or Entity” is evidence that is used by the Company/Entity, in order to perform or execute their internal controls.

Identify financial reporting risks—for every material account, see what can cause key transactions to be improperly reported. Clearly identify how risk events can affect the account balance, and as a result, the overall financial statement. The end goal of a risk assessment is to identify possible risks, existing controls, and whether they are enough to satisfy SOX requirements. If not, the next step is to develop new procedures to implement the missing controls.

- These scandals cost investors billions of dollars when the companies’ share prices collapsed and impacted public confidence in US securities markets.

- To gain that extra layer of security compliance and ensure every client’s data and financials are secure, Jotform Enterprise attained a SOC 2 Type II attestation.

- Long story short, they make sure the information and data you store is accurate and protected at all times.

- The process enables the correction and identification of a lapse and procedures.

- This was done as a response to some of the large financial scandals that had taken place over the previous years.

SOX was created to enhance the accuracy and reliability of corporate disclosures in financial statements and to guard investors from fraudulent accounting practices. Every firm like to imagine that its workers and administration are above reproach and would never do something to harm the organization. Like SOX, J-SOX requires companies to report and audit their internal control assessment.

SOX sections 302, 404 and 409 require that strict auditing, logging and monitoring take place across all internal controls, network and database activity, login activity, account activity, user activity and information access. Preparing for a SOX audit can be a stressful, expensive, and time consuming process, but it doesn’t have to be. Pathlock provides an automated, real-time solution to proving compliance with your internal controls for SOX. Continuous controls monitoring can ensure that you are always tracking your compliance, so there are no major surprises when the audit season comes around.

What is the difference between SOC 2 and ISO 27001?

SOC reports were created by the AICPA amidst the rise of cloud computing, which has increased accessibility to applications and data. As a result of this increased accessibility, the risks and liabilities have increased as well. SOC reports aim to mitigate those risks to protect businesses and help them make more informed partnership decisions.

Tony performs these types of SOC engagements all year long and is probably one of the top authorities on SOC reports. While our managing partner may go sockless at times, Tony always has a spare SOC around. When I am asked by Fund managers what is the one thing they can do to help increase my efficiency on the audit , I tell them to use an administrator that has a SOC report. It can greatly reduce my time on an audit, while allowing me to feel comfortable that the financial statements are accurately prepared. In short, it is not a question of ISO vs. SOC 2, because SOC 2 is an audit report, while ISO is a standard to establish an Information Security Management System.

Noteworthy Organizations and Frameworks

Each control is important in its own way with the risk it was created to mitigate, and each is important for the operations and financial activities of the business. Other companies, including private ones and non-profits, generally do not have to comply with SOX, although adhering to it anyway is good business practice. There are other reasons, beside good business sense, to comply with SOX even if you are not publicly traded. SOX does have some articles that state if any company knowingly destroys or falsifies financial data they could face punishment under the Act. The Sarbanes-Oxley Act of 2002 was passed by the United States Congress with the goal of providing security for consumers and the general public against corporations acting maliciously or carelessly. The general requirements of SOX compliance are geared towards ensuring that companies are transparent when it comes to financial reporting and that there are more official rules in place to prevent fraud.

The focus of this testing is to evaluate and report on the design and working effectiveness of the controls. SOC is an audit of internal controls to ensure data security, minimal waste and shareholder confidence. SOC 2 and SOC 3, demonstrates a service provider’s adoption of robust internal controls and information security practices. In short, SOX is a set of ironclad rules and regulations that public and private companies are required by law to follow. If a company were to “cook the books,” falsify documents to dodge a federal investigation, or otherwise violate SOX’s rules and standards, it would face serious legal consequences.

Adhering to SOX compliance requirements is not only the law, it is also best practice for a more ethical and secure operation. Implementing SOX financial security controls, aside from being the right thing to do, also has the added benefit of helping to defend against data security threats and attacks. SOX controls must be applied and verified in all cycles leading to the company’s financial report or financial results. Internal auditors must conduct regular compliance audits to verify that appropriate controls are in place and that they are functioning properly.

SOX VS SOC:

Evaluating how the organization restricts access and implements access control measures, to ensure only the right people can physically and electronically access sensitive financial information. This includes physical access measures like locks and video surveillance for server rooms, and digital measures like authentication and credentials management using an identity and access management solution. SOX requires organizations to create and maintain a data security policy that protects the storage and use of all financial information. SOX requires organizations to consistently implement this policy and clearly communicate it to all employees. With over 3,8000 companies listed on Japanese stock exchanges, J-SOX has a wide-reaching effect within the country.

If you only handle non-financial data and want to prove your capabilities to customers, then SOC 2 is the right answer. If you need Sarbanes-Oxley compliance when becoming a publicly-traded company, then a SOC 1 audit can be invaluable. The entity’s control owner will need to demonstrate that they considered and took the necessary steps to ascertain that the user access report they utilized to execute the control was complete and accurate. To create procedures to test the accuracy and completeness of IPE and IUC a practitioner needs to understand the IPE in detail.

The stated goal of SOX is “to protect investors by improving the accuracy and reliability of corporate disclosures.” But internal audit has a wider scope as it covers every aspect of a business, whether hiring or business strategy. SOX act protects investors by improving the reliability and accuracy of corporate disclosures. A number of provisions of the Act also apply to privately held companies, such as the willful destruction of evidence to impede a federal investigation.

Company

Testing is primarily related to Section 302 — Corporate Responsibility for Financial Reports and Section 404 — Management Assessment of Internal Controls. Service Organizational Control audits are incredibly granular, internal control reports that provide a great deal of transparency for shareholders, investors and future auditors. Long story short, they make sure the information and data you store is accurate and protected at all times.

Section 404 audits will also involve looking into staff, potentially even conducting interviews, to ensure that job descriptions match duties, and that the required training on how to handle financial data has taken place. It can be tempting to apply a control every time a risk is identified in the risk assessment process. However, this leads to a large number of controls, which can be difficult to implement and enforce and may needlessly impact business operations. As the adherence and implementation of the section is left on the discretion of the companies, ISO can provide a baseline for implementing these controls. The clauses of ISO can directly be mapped to the SOX 404 requirements and effective implementation of security controls. While SOX has brought many benefits to financial reporting and data security, remaining SOX compliant continues to rise in cost.

The State of Charge has an important role in determining the remaining capacity of the battery pack. Accurate estimation of the SOC is very complex and is difficult to implement, because of the limited battery model. SOH reflects the ability of a battery to deliver and receive energy and power. Since 2004, Brian has also run the blog/podcast called 7 Minute Security, where he shares what he has learned about information security into short, 7-minute chunks. Confidentiality – information delegated as confidential needs to have appropriate protections.

Ensure that you regularly review and monitor access controls and get real-time alerts following permission changes that could affect access to sensitive financial information. Ensure that you track anomalous logon attempts, and any tampering of financial records. SOX audits are to be carried out by external auditors within which controls, policies and procedures are all to be reviewed during a Section 404 audit. Evaluating how the organization backs up data and key systems to minimize business disruption and data loss in case of a disaster. Both the original systems, and the data center containing backups or standby systems that store financial data, must be compliant with SOX requirements. SOX Section 302—holds the CEO and CFO responsible for reporting and all related internal controls.

An internal audit also helps to know whether employees follow the internal operational standards. In the United States, SOX is a federal law that mandates practices and financial records reporting for corporations and keeping them. However, additionally it is a clever enterprise transfer to have methods in place to make sure issues are running easily and there are no points. Internal controls are procedural measures a company adopts to guard its assets and property. Broadly defined, these measures embody bodily security limitations, access restriction, locks and surveillance tools. They are extra often considered procedures and policies that defend accounting knowledge.

Both benefit an organization, strengthening their operations and building trust with investors, clients, and customers. But it is important to understand the differences between these two audits to ensure your organization is working on the one you need. To fully understand and test relevant controls during a compliance report examination, it is important that practitioners don’t get caught in a slippery slope of over-scoping and over-testing the IUC and IPE. It is also important that the practitioners take the steps necessary to understand the controls that are relevant to their procedures, and whether those controls are dependent upon IPE or IUC. After that determination is made is when an auditor will be able to effectively conclude on the design appropriateness and operating effectiveness of the control with each of the important considerations necessary to do so.

Since most customers know the limitations of a Type 1 audit, they will be looking for Type 2. The SOH decrement of a battery cell is mostly caused by battery aging and degradation, namely, durability problems. That means with the using or storing of the battery cells, the battery capacity would decrease and the internal resistance would increase. Take the capacity as an example, SOH could be defined as the ratio of the current capacity and the rated capacity given by the manufacture.

SOX requires organizations to create and maintain compliance documentation, which must be provided to auditors upon request. Additionally, organizations are required to continually perform SOX control testing, as well as monitor and measure SOX compliance objectives. Contain an assessment, as of the end of the most recent fiscal year of the issuer, of the effectiveness soc vs sox of the internal control structure and procedures of the issuer for financial reporting. One of those sections is SOX 404 that is responsible for making sure that the internal controls for a financial system are adequate, assessed and attested by the management. Any shortcomings in these security controls should also be reported in the disclosures.